25 Oct Economically Speaking: Must All Good Things Come to an End?

Each year, The Hotel Lodging Conference invites leading economists to offer their predictions for the Hotel industry. This year, there was more belief in their predictions than in prior years. I say belief because judging by their presentations it was clear they included their political preference as part of their forecasting.

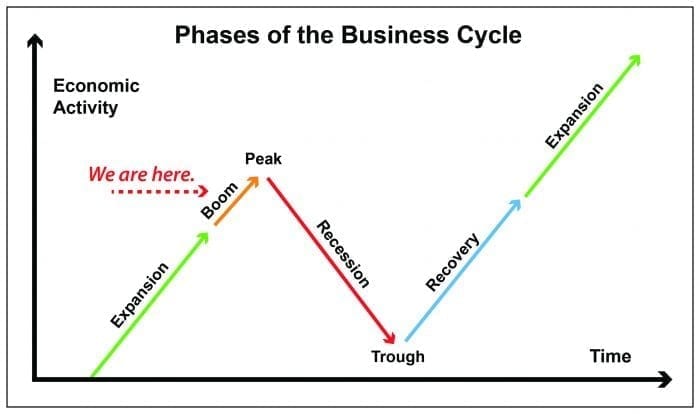

The conclusion/question: How long could the good times roll?

The pessimistic and optimistic outlooks agree – Something will happen to the economy in the next two years. However, the degree of impact was tainted by their political outlook.

Readers of this newsletter understand that as an estimator, I use key indicators to provide an early warning sign of how to predict future construction pricing. This newsletter has a report on one of those early warning signs and how it will affect design and construction.

EARLY WARNING SIGNS:

Since the 1980’s, the peak in residential housing starts has been the most reliable early warning economic indicator. This alert has correctly predicted the last three economic downturns. I like this indicator because it offers guidance 12 to 18 months in advance of the event. I would not run to the hills on just one indicator but it does tell us to stay alert for other signs that our economy may be changing.

The actual trigger for the economic downturn isn’t necessarily a direct link to housing. Also a peak can be followed by a trough as the housing industry increases the housing starts, resulting in a reset of the indicator.

At the Lodging Conference, the economists noted that they saw a peak in housing starts in April 2018. They shared that for the last four months, housing starts have declined or have been flat.

Translation: We should be on the lookout for addition signs for a change in the economy in the 2nd or 3rd quarter of 2019.

The degree of impact on the economy is never known, however the Beaulieu brothers from “Industrial Trends Research” have stated the adjustment should be mild, lasting 6 to 9 months – similar to what was experienced in 2000 after the dot.com bust. After that, the prediction is for a robust economy until the late 2020’s. If you listen to the pessimistic economists they “believe” the downturn to be drastic enough to cause Trump to lose the White House. Not sure if this is more of a desired outcome or a real economic prediction.

Interestingly, they agree on the time frame.

FOR OWNERS:

Establish your project budgets and secure financing prior to the spring of 2019. Expect construction escalation to be in the 3–5% range until then. We are advising Owners that construction pricing will continue to rise through most of next year. The lack of workforce and capacity of contractors and subcontractors will cause project costs to increase. Lock in penalties for late delivery of projects. The industry continues to suffer due to insufficient talent. When offered a choice to waive contractor or subcontractor bonds – decline the cost savings.