25 Jun Tariffs Effect On The Construction Industry

In March, the US Government announced their intention to level new tariffs on steel and aluminum imports. Tariffs on steel were to be 25% and aluminum was to be 10%. The United States Department of Commerce indicates that the U.S. is the world’s largest importer of steel with approximately 34.6 million metric tons in 2017, which accounts for 33% of the total steel used in the country. Behind steel, aluminum is the second most widely used metal in construction.

The real question is, what does this really mean for the cost of your construction project?

The steel and aluminum industries require additional investment to catch up with the efficiency of the overseas plants. Lower costs from overseas producers of steel and aluminum has strapped the domestic manufactures limiting their reinvestment in domestic manufacturing. The recent tax legislation enables all firms to accelerate depreciation of investments in manufacturing plant and machinery. The threat of additional costs due to tariffs for overseas manufacturers provides the industry a way to increase prices.

As an estimator of more than 40 years, I have followed the market’s response to price increases and I expect these price increases will follow the same typical patterns. The prevalent pattern has been that the initial shock of a price increase due to shortages or tariffs, will generate a significant press coverage, causing material suppliers to either 1) purchase and stockpile the product at the current prices so they can resell the product at a higher price, or 2) start quoting higher prices and selectively adjust those prices downward based on orders they receive. It is not uncommon for sizable orders to obtain the greatest discounts. The resulting effect is that a portion of the increase will hold but not the stipulated up-charge.

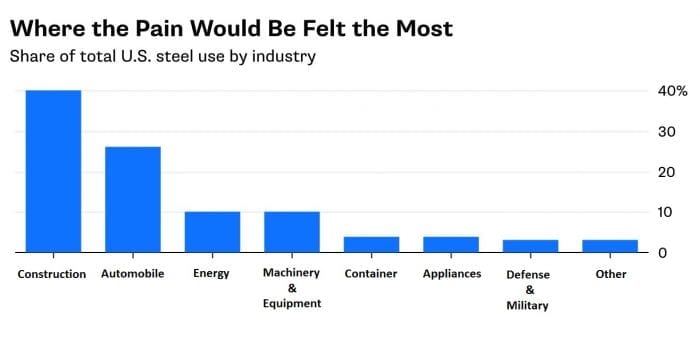

The industries most effected by the tariffs are reflected in the chart below.

Source: Statista.com

Source: Statista.com

There will be a shift to domestic production of steel and aluminum. The capacity of the existing plants will only be able to absorb a portion of the required product and the construction industry will still need to rely on imported materials. The resulting effect will also cause overseas manufactures to discount their goods to make their product competitive thus applying pressure on their margins.

My experience has been that about 40 – 50% of the cost increase will be accepted by the construction industry and passed along to owners. Engineering News Record (ENR) monitors material pricing and their June report indicates that over the last year, aluminum sheets have decreased in cost by .4% and structural steel shapes have increased by 2.4%. This is 4 months after the tariffs had been announced.

While new contracts will be effected, most existing contracts do not allow for such increases to be passed along to the general contractor and owner. Owners should refer to their contracts before agreeing to any increase.

While material pricing issues are in the news, the shortage of construction labor and the resulting price increases required to keep labor on the project is not a common news story. In a future newsletter, I will discuss the relationship with construction labor cost increases as it relates to geography. It is not what you would expect.